- The Agency Alchemist's Newsletter

- Posts

- The 3-Hour Agency Audit: How to Identify $50K+ in Hidden Profit Leaks

The 3-Hour Agency Audit: How to Identify $50K+ in Hidden Profit Leaks

In Today's Issue:

The Problem: Why 80% of agencies operate 20% below optimal profit margins

The Solution: A systematic 3-hour audit framework that reveals hidden profit leaks

The Process: Step-by-step diagnostic checklist you can implement this week

The Results: Real case studies showing $50K-$150K in annual recoveries

Introduction: The $73,000 Afternoon That Changed Everything

Sarah thought her digital marketing agency was thriving. With $2.1M in annual revenue and a growing team of 18, the numbers looked impressive on paper. But during a routine financial review, she discovered something that made her stomach drop.

Her agency was bleeding money—$73,000 annually—through operational inefficiencies she couldn't even see.

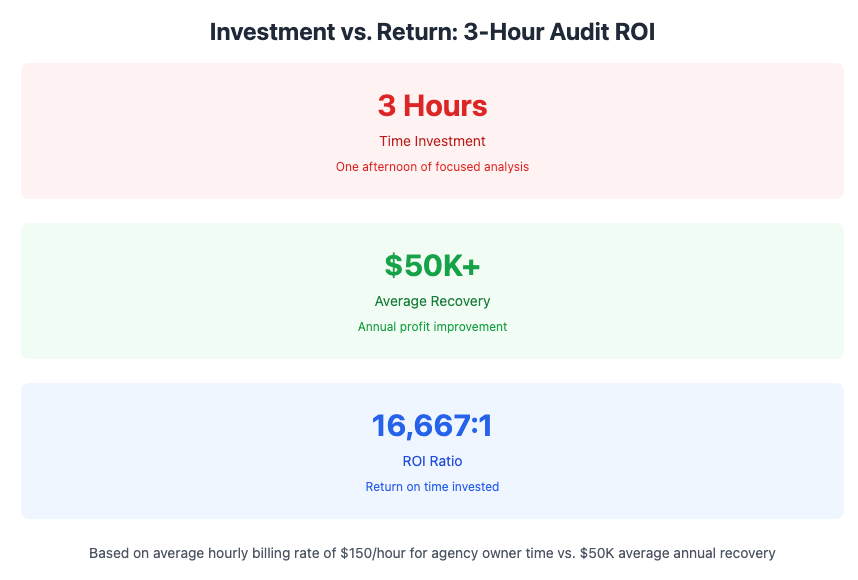

The revelation came during what she now calls "the most expensive afternoon of my career." In just three hours of systematic analysis, Sarah identified profit leaks that had been silently draining her business for years. Billing discrepancies, contract drift, and untracked time were collectively costing her the equivalent of two senior employees' salaries.

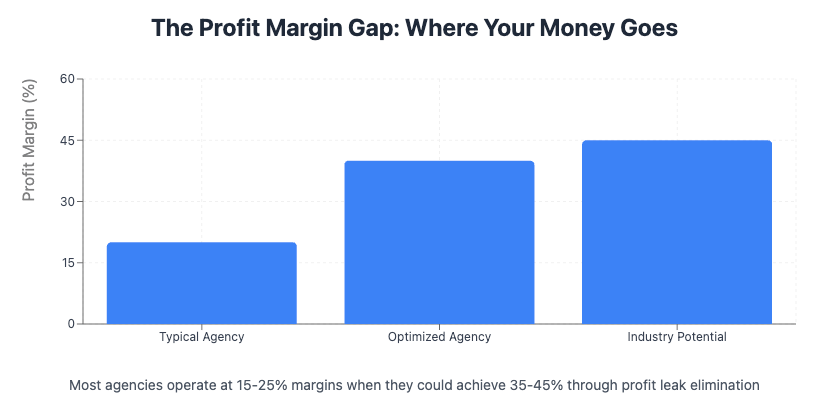

Sarah's story isn't unique. Research indicates that most agencies operate with 15-25% profit margins when they should achieve 35-45%. This gap represents millions of dollars in lost profit across the industry—money that's earned but never collected due to systematic operational blind spots.

The difference between thriving agencies and struggling ones isn't always revenue growth. It's operational efficiency and profit optimization.

Understanding Revenue Leakage in Agency Operations

Revenue leakage represents money that has been earned but not collected, typically due to business process failures rather than client payment issues. For agencies, this manifests through multiple channels that compound over time.

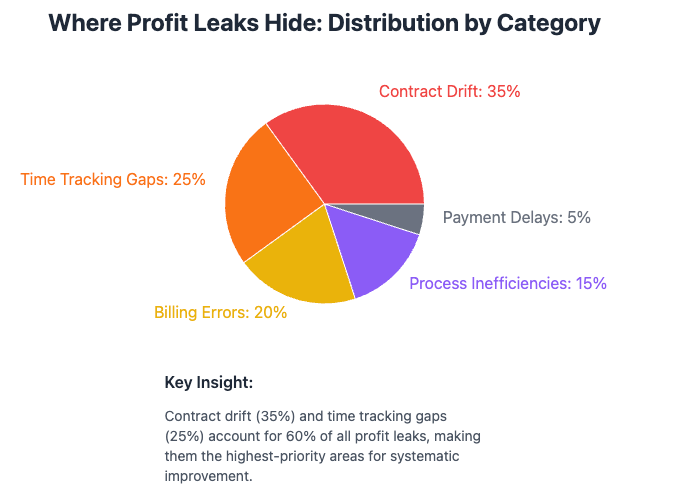

The most common profit leak categories include:

Billing inaccuracies - Scope changes that never make it to invoices

Contract drift - Services delivered beyond agreed terms without rate adjustments

Time tracking gaps - Billable hours that disappear into administrative black holes

Expense miscategorization - Costs attributed to wrong projects or not captured at all

Payment processing inefficiencies - Late fees, failed collections, and extended payment cycles

Why Traditional Financial Reviews Miss These Leaks

Most agencies rely on monthly P&L reviews and annual financial assessments. While these provide high-level visibility, they miss the granular operational inefficiencies that create profit leakage.

Traditional accounting focuses on what happened, not what should have happened. The gap between these two realities is where profit leaks hide.

Consider this example: An agency consistently delivers 5-10 hours of additional work per client project due to scope creep, but only bills for the original estimate. Over 50 projects annually, this represents 250-500 unbilled hours—potentially $50,000+ in lost revenue.

The 3-Hour Profit Leak Diagnostic Framework

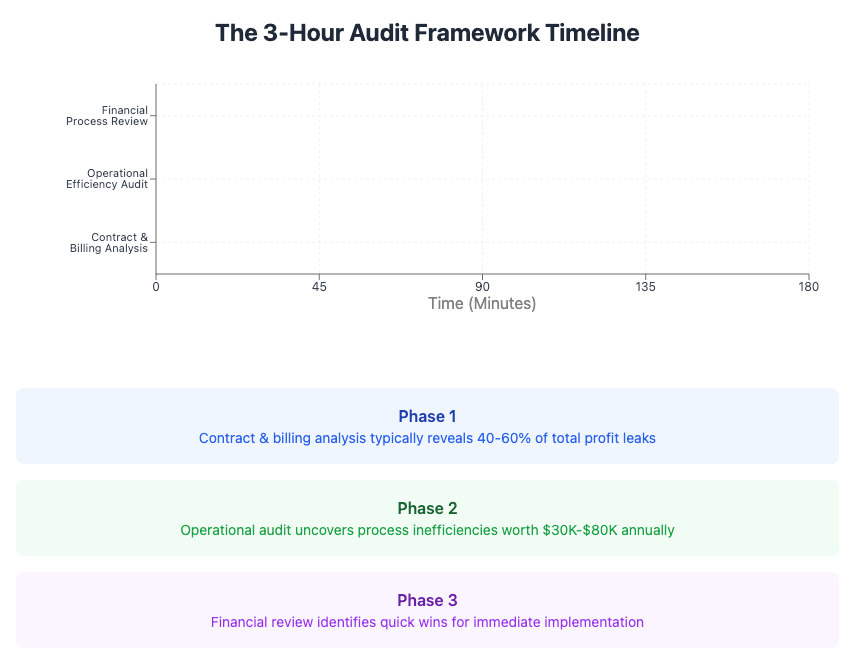

Phase 1: Contract and Billing Analysis (60 Minutes)

Step 1: Contract Compliance Review Pull your last 10 completed projects and compare final deliverables against original contracts. Look for:

Services delivered beyond scope

Timeline extensions without rate adjustments

Additional revisions provided at no charge

Deliverables that exceed contractual requirements

Step 2: Billing Accuracy Assessment Compare project timesheets against final invoices for the same 10 projects:

Hours worked vs. hours billed

Expense reimbursements requested vs. collected

Revision rounds completed vs. charged

Team members involved vs. billed rates applied

Expected Findings: Most agencies discover 15-30% more billable activity than they actually invoiced.

Phase 2: Operational Efficiency Audit (90 Minutes)

Step 3: Time Tracking Analysis Review your team's time allocation across all activities:

Administrative time that should be billable

Client work performed outside tracked hours

Project management time not allocated to clients

Business development activities that should be project-specific

Step 4: Process Bottleneck Identification Map your typical project workflow and identify delays:

Client approval cycles that extend project timelines

Internal review processes that create redundancy

Communication breakdowns that require rework

Resource allocation conflicts that slow delivery

Step 5: Technology and Tool Assessment Evaluate your current systems for efficiency gaps:

Manual processes that could be automated

Duplicate tools serving similar functions

Integration failures creating manual data entry

Reporting processes that consume excessive time

Phase 3: Financial Process Review (30 Minutes)

Step 6: Payment and Collection Analysis Examine your financial processes for improvement opportunities:

Average payment collection time vs. industry standards

Failed payment processing rates and causes

Invoice dispute resolution time and costs

Late payment follow-up effectiveness

Expected Outcome: This systematic review typically identifies $50,000-$150,000 in annual profit recovery opportunities for agencies generating $1M-$5M in revenue.

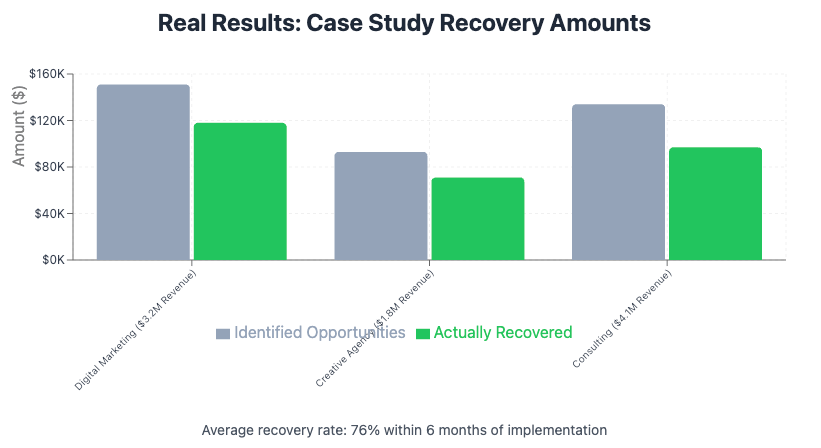

Real-World Implementation Case Studies

Case Study 1: Digital Marketing Agency Recovery

Agency Profile: $3.2M annual revenue, 24 employees, specializing in B2B lead generation

Audit Results:

Contract drift losses: $89,000 annually in uncompensated scope expansion

Time tracking gaps: $34,000 in unbilled strategic consulting hours

Process inefficiencies: $28,000 in redundant workflow costs

Total recovery opportunity: $151,000 annually

Implementation Impact: Within 90 days of implementing systematic tracking and billing processes, the agency recovered 78% of identified opportunities, adding $118,000 to annual profit.

Case Study 2: Creative Agency Transformation

Agency Profile: $1.8M annual revenue, 16 employees, focus on brand development and creative services

Audit Results:

Revision cycle losses: $43,000 in unlimited revision commitments

Project management gaps: $31,000 in unallocated PM time

Technology redundancy: $19,000 in overlapping tool subscriptions

Total recovery opportunity: $93,000 annually

Implementation Impact: The agency restructured contracts to include revision limits and implemented project-specific billing for management time, recovering $71,000 in the first year.

Case Study 3: Consulting Agency Optimization

Agency Profile: $4.1M annual revenue, 31 employees, management consulting focus

Audit Results:

Billing accuracy issues: $67,000 in undercharged senior consultant time

Expense tracking gaps: $29,000 in unreimbursed client expenses

Administrative inefficiency: $38,000 in non-billable time that should be client-charged

Total recovery opportunity: $134,000 annually

Implementation Impact: Through systematic process improvements and billing restructuring, the agency recovered $97,000 within six months.

Implementation Strategy: From Audit to Action

Week 1: Conduct Your Diagnostic Audit

Use the 3-hour framework to identify your specific profit leaks. Document everything systematically and quantify potential recovery amounts for each identified issue.

Critical Success Factors:

Focus on data, not assumptions

Quantify everything in dollar terms

Prioritize highest-impact opportunities

Involve key team members in the process

Week 2-4: Design Remediation Systems

Create systematic processes to address identified leaks:

For Contract Management:

Implement scope change order processes

Create revision limit policies

Establish rate escalation procedures for timeline extensions

For Time Tracking:

Deploy comprehensive time tracking systems

Create project-specific billing categories

Implement administrative time allocation policies

For Process Optimization:

Automate manual workflows where possible

Eliminate redundant tools and processes

Create standardized project management protocols

Month 2-3: Monitor and Refine

Track implementation progress and measure results:

Monthly profit margin analysis

Client profitability assessments

Process efficiency measurements

Team productivity metrics

Expected Timeline for Results: Most agencies see measurable profit improvements within 60-90 days of implementation, with full recovery potential realized within 6 months.

Long-Term Profit Optimization Strategy

Systematic Monitoring and Continuous Improvement

Successful profit optimization requires ongoing attention and systematic monitoring. Implement quarterly audit cycles to identify new leaks and optimize existing processes.

Quarterly Review Focus Areas:

Contract performance against profitability targets

Time allocation efficiency across all projects

Technology ROI and utilization rates

Client profitability and relationship optimization

Technology Integration for Automated Monitoring

Modern business intelligence tools can automate much of the diagnostic process, providing real-time visibility into profit leak indicators. Consider implementing integrated systems that connect project management, time tracking, and financial reporting.

Key Technology Capabilities:

Automated billing discrepancy detection

Real-time project profitability monitoring

Contract compliance tracking

Predictive profit leak identification

Building a Culture of Operational Excellence

Long-term success requires team buy-in and systematic attention to operational efficiency. Create accountability systems and performance metrics that reinforce profit optimization behaviors.

Cultural Implementation Strategies:

Regular team training on efficiency best practices

Performance metrics that include profit optimization

Recognition systems for process improvement contributions

Client communication strategies that support profitable operations

Conclusion: Your Next Steps

The agencies that thrive in competitive markets aren't necessarily those with the highest revenue—they're the ones with optimized operations and maximized profit margins. The difference between a 20% margin and a 40% margin isn't just numbers on a financial statement; it's the foundation for sustainable growth, competitive resilience, and strategic flexibility.

Your 3-hour audit investment can reveal profit opportunities that transform your agency's financial trajectory. The question isn't whether you have profit leaks—research shows that virtually all agencies do. The question is whether you'll take the systematic approach necessary to find and fix them.

Start your audit this week. The $50,000+ you recover could fund your next strategic hire, technology upgrade, or market expansion initiative.

Ready to begin? Block three hours on your calendar this week and work through the diagnostic framework. Your future self—will thank you.